#nucleic acid extraction

Explore tagged Tumblr posts

Text

DNA and RNA Sample Preparation Market is Estimated to Witness High Growth Owing to Increasing Adoption

The DNA and RNA sample preparation market involves processes associated with isolation, extraction, purification and quantification of nucleic acids DNA and RNA from various sources like tissues, blood, sperm, cells etc. for downstream applications in genomics, molecular diagnostics, personalized medicine and others. The sample preparation is a critical and initial step before conducting various genomic tests including Next Generation Sequencing, polymerase chain reaction and other assays. Growing awareness and adoption of precision medicine and genetic/molecular testing is driving demand for efficient nucleic acid isolation and downstream analysis.

The Global DNA and RNA Sample Preparation Market is estimated to be valued at US$ 2262.46 Mn in 2024 and is expected to exhibit a CAGR of 5.8% over the forecast period 2024 To 2031. Key Takeaways Key players operating in the DNA and RNA sample preparation are Agilent Technologies, Inc., Becton, Dickinson and Company, Bio-Rad Laboratories Inc., DiaSorin S.p.A, F. Hoffmann-La Roche, Miroculus, Inc., Illumina, Inc., PerkinElmer, Inc., QIAGEN, Sigma Aldrich Corp., Tecan Group AG, and Thermo Fisher Scientific, Inc. Growing prominence of personalized medicine is creating opportunities for development of new sample preparation methods and kits which can extract nucleic acids from various types of samples. Rising incidence of chronic and infectious diseases worldwide is increasing diagnostic testing which will propel sample preparation market growth. Global expansion of key market players through acquisitions and partnerships with regional diagnostic labs and research institutes will further augment market revenues. Market Drivers Increasing funding for Genomic and genetic research from government bodies as well as private sector is one of the key factors driving the DNA and RNA Sample Preparation Market Size. Government initiatives aimed at large scale population screening and clinical testing for various genetic disorders, infectious diseases and cancers are also creating demand for high throughput nucleic acid preparation. Growing geriatric population and rising healthcare spending in developing nations also provides growth opportunities for market players in the forecast period.

PEST Analysis Political: Laws and regulations imposed by governments for research using DNA and RNA samples could impact the market. Changes in healthcare policies will also have effects. Economic: Factors like GDP growth, income levels, healthcare spending will drive demand. Rise in research activities and focus on precision medicine boost the market. Social: Growing awareness about personalized medicine and importance of genetic testing are important. Social trends also promote preventive healthcare and wellness. Technological: Advancements in fields like next generation sequencing, lab automation, bioinformatics are key for market growth. Miniaturization and portability of equipment expand applications. Developments in sample collection and storage methods improve efficiency. Geographical regions where the market in terms of value is concentrated include North America and Europe. North America accounts for the largest share in the global market due to presence of well-established healthcare industry and research institutes. Europe also captures notable share due to growing biotech sector and research funding. The Asia Pacific region is projected to be the fastest growing market during the forecast period. This is attributed to factors such as increasing healthcare expenditure, growing awareness, expanding biotech industry and rising government investments in research. Countries like China, India offer growth opportunities as they focus on healthcare infrastructure development.

Get more insights on DNA And RNA Sample Preparation Market

Also read related article on Surgical Robots Market

Discover the Report for More Insights, Tailored to Your Language

French

German

Italian

Russian

Japanese

Chinese

Korean

Portuguese

Vaagisha brings over three years of expertise as a content editor in the market research domain. Originally a creative writer, she discovered her passion for editing, combining her flair for writing with a meticulous eye for detail. Her ability to craft and refine compelling content makes her an invaluable asset in delivering polished and engaging write-ups.

(LinkedIn: https://www.linkedin.com/in/vaagisha-singh-8080b91)

#Coherent Market Insights#DNA And RNA Sample Preparation Market#DNA And RNA Sample Preparation#RNA Sample Preparation#Nucleic Acid Extraction#Genetic Material Isolation#DNA Extraction#RNA Extraction#Molecular Biology#Genomic DNA

1 note

·

View note

Text

Introducing Rapi-X96, fully automated #Nucleic Acid Extraction System that revolutionizes sample processing with its magnetic bead-based #technology and 96-well plate format, enabling simultaneous extraction of 96 samples. This advanced system uses #magnetic beads and buffer reagents to separate and purify high-quality nucleic acids from various sample sources, including blood, #tissues, viruses, and body fluids.

#G2M Rapi-X96 extraction #system ensures efficient and high-quality nucleic acid extraction, streamlining your laboratory workflow and enhancing productivity.

Contact us at [email protected] or +91 8800821778 if you need any further assistance !

Visit our website for more information: https://www.genes2me.com/nucleic-acid-extraction-system

#extraction #purification #automated #nucleicacid #buffer #genes2me #blood #sources

#g2m#genes2me#extraction#purification#automated#buffer#magnetic#system#tissue#nucleic acid extraction#nucleic acid#nucleic acid extraction system

0 notes

Text

Nucleic Acid Extraction System Market Size, Share, Scope and Trends for 2022-2032

The nucleic acid extraction systems market in europe commands a significant share of 28.6%. Leading biotechnology firms in the region are actively engaged in commercialization and expanding their operational footprint, a trend that is anticipated to fuel additional growth in the nucleic acid extraction system market.

Globally, the nucleic acid extraction system market size is poised for notable expansion, with a robust compound annual growth rate (CAGR) of 11.4%. This growth trajectory is expected to elevate the market's value from $4.63 billion in 2022 to a projected $13.64 billion by the conclusion of 2032.

Download a Sample Copy of This Report: https://www.factmr.com/connectus/sample?flag=S&rep_id=432

In the fast-evolving landscape of healthcare and research, the global nucleic acid extraction system market is experiencing a remarkable surge, driven by an escalating demand for advanced molecular diagnostics. As the healthcare industry continues to prioritize precision and personalized medicine, the need for efficient and reliable nucleic acid extraction systems has become paramount.

Rising Demand for Precision Medicine:

The increasing emphasis on precision medicine, which tailors medical treatment to the individual characteristics of each patient, has fueled the demand for advanced molecular diagnostics. Nucleic acid extraction systems play a pivotal role in this paradigm shift by enabling the isolation and analysis of genetic material with unprecedented accuracy. This surge in demand is evident across diverse applications, including oncology, infectious diseases, genetic disorders, and pharmacogenomics.

Technological Advancements Driving Market Growth:

The market surge is closely tied to rapid advancements in nucleic acid extraction system technologies. Cutting-edge innovations, such as automated extraction processes, high-throughput capabilities, and integrated sample-to-answer solutions, are enhancing efficiency and reducing turnaround times. These technological breakthroughs not only improve diagnostic accuracy but also contribute to cost-effectiveness, making molecular diagnostics more accessible to a broader range of healthcare providers and research institutions.

Impact of the COVID-19 Pandemic:

The global COVID-19 pandemic has further accelerated the adoption of nucleic acid extraction systems. These systems have played a critical role in the development and deployment of diagnostic tests for the SARS-CoV-2 virus. The urgency to enhance testing capabilities and the need for reliable molecular diagnostics have propelled the market to new heights, with governments, healthcare organizations, and research institutions investing significantly in advanced extraction technologies.

Competitive Landscape

Major industry leaders are actively engaged in multiple initiatives aimed at expanding the range of nucleic acid extraction instruments and kits. Their objective is to enhance the advantages for end users and accelerate the pace of research by exploring and integrating innovative and efficient solutions.

A notable example of this trend is seen in Thermo Fisher's strategic move in 2020 when it acquired QIAGEN N.V., a prominent global provider of diagnostic techniques and sample preparation technology. This strategic investment is anticipated to broaden the company's specialty diagnostics portfolio by introducing groundbreaking sample processing, testing, and bioinformatics solutions. The goal is to provide users with cutting-edge tools that not only optimize efficiency but also contribute to a faster turnaround time in research endeavors.

Key Segments Covered in Nucleic Acid Extraction System Industry Research

By Product :

DNA Extraction

RNA Extraction

Protein Extraction

By Application :

Hospitals & Diagnostic Centers

Life Science

Pharmaceuticals

Academic

Medical and Clinical Research

By Region :

North America

Europe

Asia Pacific

Latin America

Middle East & Africa

Get Customization on this Report: https://www.factmr.com/connectus/sample?flag=Rc&rep_id=432

The surge in the global nucleic acid extraction system market reflects a broader trend towards precision medicine and advanced molecular diagnostics. As technology continues to advance and applications expand, these systems will play an increasingly integral role in shaping the future of healthcare and research. The market's upward trajectory underscores the critical importance of reliable and efficient nucleic acid extraction in the pursuit of accurate and personalized medical solutions.

Contact: US Sales Office 11140 Rockville Pike Suite 400 Rockville, MD 20852 United States Tel: +1 (628) 251-1583, +353-1-4434-232 Email: [email protected]

#Nucleic Acid Extraction System Market#DNA Extraction System#RNA Extraction System#Protein Extraction System#Demand for Nucleic Acid Extraction System

1 note

·

View note

Text

Automated Nucleic Acid Extraction System Market Drivers and Technological Advancements to Watch in 2025

The Automated Nucleic Acid Extraction System market has seen considerable growth over the past few years. This growth can be attributed to several factors that drive the adoption of automated nucleic acid extraction technologies across various industries, including diagnostics, research, and pharmaceuticals. In this article, we will explore the key drivers contributing to the expansion of this market.

Increasing Demand for Efficient Diagnostic Solutions

The rise in the number of chronic and infectious diseases globally has significantly increased the demand for diagnostic solutions that offer speed and accuracy. Traditional manual methods of nucleic acid extraction can be time-consuming, error-prone, and labor-intensive. Automated systems, on the other hand, offer a faster and more consistent alternative, ensuring that diagnostic tests are both efficient and accurate. The shift toward automation is being fueled by the need for quick, reliable diagnostics in fields like molecular biology, clinical diagnostics, and oncology.

Advancements in Technology and Integration with Other Platforms

The integration of artificial intelligence (AI) and machine learning (ML) into nucleic acid extraction systems has enhanced their functionality and efficiency. These technologies help automate several aspects of the extraction process, improving accuracy and reducing the chances of human error. Additionally, the development of more sophisticated software systems that can control multiple stages of nucleic acid extraction has also played a pivotal role in driving market growth. As technology advances, automated systems are becoming more reliable and customizable, catering to the unique needs of different industries.

Rise in Biotechnology and Pharmaceutical Research

The biotechnology and pharmaceutical sectors are key drivers of the automated nucleic acid extraction system market. Research and development (R&D) activities within these industries require consistent and high-quality extraction of nucleic acids for the creation of new drugs, vaccines, and therapies. Automated systems allow researchers to process large volumes of samples quickly and with a higher degree of precision, leading to faster drug discovery and more effective therapeutic interventions. As the biotechnology industry continues to grow, the demand for automated nucleic acid extraction systems is expected to rise.

Focus on Improving Laboratory Productivity and Reducing Errors

Automated systems are seen as essential for improving laboratory productivity and reducing errors. With automation, laboratory technicians can focus on more complex tasks, while the system handles routine processes such as nucleic acid extraction. This results in improved efficiency, higher throughput, and a reduction in human errors. Moreover, automated systems help labs handle large volumes of samples simultaneously, which is crucial for research and clinical settings that deal with a significant number of tests. This focus on productivity and error reduction continues to fuel the adoption of automated nucleic acid extraction systems.

Government Initiatives and Funding for Healthcare Innovations

Governments across the globe are investing heavily in healthcare innovations to improve public health and support research initiatives. Funding and grants are often provided to support the development of new medical technologies, including automated nucleic acid extraction systems. Governments are particularly focused on supporting innovations that enhance diagnostic capabilities and improve the efficiency of healthcare delivery. These investments are not only accelerating the development of automated extraction systems but also making them more affordable and accessible to healthcare providers worldwide. With ongoing support from government bodies, the adoption of automated nucleic acid extraction systems is set to increase further.

Expanding Applications in Clinical and Forensic Laboratories

Automated nucleic acid extraction systems have found applications in clinical diagnostics, forensic investigations, and even environmental testing. In clinical labs, they are used for genetic testing, disease detection, and monitoring of infectious diseases. In forensic labs, these systems help in the extraction of DNA from crime scene samples, facilitating criminal investigations. The expanding range of applications across various industries is contributing to the market's growth. The ability to process diverse samples efficiently and with high reliability is a key factor in the increasing adoption of these systems.

Emerging Markets and Adoption in Developing Countries

While the adoption of automated nucleic acid extraction systems has been high in developed countries, emerging markets, especially in Asia-Pacific and Latin America, are showing increased interest in these technologies. As these regions continue to modernize their healthcare infrastructure and research facilities, the demand for automated systems is expected to surge. Healthcare providers in developing countries are increasingly recognizing the value of automation in improving diagnostic capabilities and operational efficiency. This growing awareness and investment in automation in emerging markets are key drivers of the global market.

Conclusion

The Automated Nucleic Acid Extraction System market is poised for continued growth due to a variety of drivers. These include the increasing demand for efficient diagnostic solutions, advancements in technology, and a growing focus on improving productivity and reducing errors. Moreover, the ongoing support from governments and the expanding applications in clinical and forensic settings further contribute to market expansion. As these systems become more advanced and accessible, their adoption is set to accelerate, reshaping the landscape of nucleic acid extraction.

1 note

·

View note

Text

Best Practices for Selecting a Nucleic Acid Extraction Kit

Selecting the best nucleic acid extraction kit for DNA and RNA isolation is crucial for obtaining reliable and reproducible results in molecular biology applications. By considering factors such as sample type, nucleic acid requirements, extraction methods, and kit performance, you can choose a kit that ensures the highest quality of isolated nucleic acids.

Whether you’re working with clinical samples, research specimens, or microbial cultures, understanding these considerations will help you streamline your nucleic acid extraction process and achieve accurate results in your experiments.

0 notes

Text

Nucleic Acid Extraction Instruments & Reagents Market: Regional Insights and Opportunities

In the rapidly evolving field of molecular biology, nucleic acid extraction instruments and reagents play a crucial role in enabling accurate and efficient analysis of genetic material. These technologies are foundational to various applications, from basic research to advanced diagnostics, underpinning significant advancements in genomics and personalized medicine. This blog post provides a detailed analysis of the nucleic acid extraction instruments and reagents market, covering market dynamics, segmentation, regional insights, competitive landscape, and future outlook.

The nucleic acid extraction instruments and reagents market encompasses a diverse range of products and technologies designed to facilitate the extraction and analysis of DNA and RNA from various biological samples. This market includes sophisticated instruments, extraction kits, reagents, and consumables that collectively support a broad spectrum of molecular biology applications. The growth of this market is driven by increasing research activities, technological advancements, and the rising prevalence of genetic disorders, which have heightened the demand for efficient and reliable nucleic acid extraction solutions.

Market Dynamics

Drivers

Several factors are driving the growth of the nucleic acid extraction market. The proliferation of genomics research and the growing emphasis on personalized medicine are major contributors. As researchers and clinicians strive to understand genetic variations and develop targeted therapies, the need for advanced nucleic acid extraction technologies has surged. Furthermore, the increasing incidence of genetic disorders and the expansion of clinical genomics are pushing the demand for efficient extraction solutions. These drivers are fostering innovation and spurring the development of new products and technologies in the market.

Restraints

Despite the market’s growth potential, challenges such as high costs associated with advanced instruments and stringent regulatory requirements could impede its expansion. The initial investment required for state-of-the-art nucleic acid extraction technologies can be substantial, potentially limiting accessibility for smaller laboratories and research institutions. Additionally, compliance with rigorous regulatory standards for accuracy and reliability can pose challenges for market players, particularly those seeking to introduce new or improved products.

Opportunities

Emerging technologies and increasing adoption of personalized medicine offer significant opportunities for market players. The integration of next-generation sequencing (NGS) and other cutting-edge technologies into nucleic acid extraction workflows is opening new avenues for research and clinical applications. Additionally, the growing focus on precision medicine is driving demand for versatile and high-performance extraction solutions. Companies that can innovate and offer solutions that meet these evolving needs are well-positioned to capitalize on the expanding market opportunities.

Challenges

The nucleic acid extraction market faces several challenges, including the need for continuous innovation and maintaining high standards of quality control. As the field of molecular biology advances, there is a constant demand for new and improved extraction methods that offer higher efficiency, accuracy, and reliability. Moreover, ensuring consistent quality and performance across different products and technologies is crucial for maintaining customer trust and meeting regulatory standards. Addressing these challenges is essential for sustaining growth and driving future market development.

Market Segmentation

By Type

Instruments

Instruments for nucleic acid extraction, including automated systems and manual devices, are essential for improving throughput and accuracy in genetic analysis. Automated systems, which streamline the extraction process and reduce manual handling, are particularly valuable in high-throughput laboratories and clinical settings. Manual devices, on the other hand, offer flexibility and are often used in smaller laboratories or specialized applications. The choice between automated and manual systems depends on factors such as sample volume, required precision, and available budget.

Extraction Kits, Reagents, and Consumables

Extraction kits, reagents, and consumables are critical components that support various nucleic acid extraction methods and ensure the reliability of the results. Kits typically include all necessary reagents and protocols for specific extraction applications, such as DNA or RNA isolation. Reagents are essential for various steps in the extraction process, including cell lysis, nucleic acid binding, and purification. Consumables, such as tubes, pipette tips, and filters, are necessary for conducting extraction procedures and maintaining laboratory efficiency.

By Extraction Type

DNA Extraction

DNA extraction methods focus on isolating and purifying deoxyribonucleic acid from biological samples, which is crucial for genetic research and diagnostics. These methods are employed in a wide range of applications, including genetic profiling, forensic analysis, and cancer research. DNA extraction technologies have evolved to offer higher yields, greater purity, and faster processing times, supporting the growing demands of modern genomics.

RNA Extraction

RNA extraction techniques are specifically designed to isolate ribonucleic acid, which is essential for studying gene expression and functional genomics. RNA extraction presents unique challenges due to the instability of RNA molecules, requiring careful handling and specialized protocols to ensure accurate results. Advances in RNA extraction technologies are enabling researchers to gain deeper insights into gene expression patterns and regulatory mechanisms.

DNA/RNA Extraction

Combined DNA/RNA extraction methods streamline the process of isolating both types of nucleic acids from a single sample, enhancing efficiency in molecular studies. These methods are particularly valuable in applications where simultaneous analysis of DNA and RNA is required, such as in cancer research and gene expression studies. By integrating both extraction processes, researchers can achieve more comprehensive insights from a single sample.

By Method

Solution-based Methods

Solution-based methods involve the use of chemical reagents and solutions to extract nucleic acids, offering flexibility and adaptability for various types of samples. These methods typically rely on precipitation or solvent-based approaches to isolate nucleic acids from cellular components. Solution-based methods are widely used due to their versatility and compatibility with different sample types, including blood, tissue, and cell cultures.

Solid-phase-based Methods

Solid-phase-based methods utilize specialized materials such as silica or magnetic beads to capture and purify nucleic acids, providing high specificity and yield. These methods are based on the principle of nucleic acid binding to solid surfaces, which allows for efficient separation and purification. Solid-phase-based methods are particularly advantageous for high-throughput applications and automated systems, where consistency and reproducibility are critical.

By End User

Hospitals

Hospitals rely on nucleic acid extraction technologies for diagnostic testing and personalized medicine, making them a significant end-user segment in the market. Nucleic acid extraction is integral to various diagnostic procedures, including genetic testing, pathogen detection, and cancer diagnostics. The increasing focus on personalized medicine is driving hospitals to adopt advanced extraction technologies that support tailored treatment approaches and improved patient outcomes.

Academic & Research Institutes

Academic and research institutes use nucleic acid extraction instruments and reagents for a wide range of research applications, from basic science to applied genomics. These institutions are at the forefront of developing new techniques and technologies, contributing to advancements in molecular biology and genetics. The demand for high-quality extraction solutions is driven by the need for accurate and reproducible results in diverse research areas.

Diagnostic Centers

Diagnostic centers leverage advanced extraction technologies to conduct genetic testing and diagnostics with high precision and reliability. These centers play a crucial role in providing accurate diagnostic information for patient management and treatment planning. The growing demand for genetic testing and the need for rapid, reliable results are driving the adoption of advanced nucleic acid extraction technologies in diagnostic settings.

Pharmaceutical & Biotechnology Industry

The pharmaceutical and biotechnology industries utilize nucleic acid extraction for drug development, biomarker discovery, and therapeutic research. These industries rely on extraction technologies to support various stages of drug development, including target identification, validation, and biomarker discovery. The increasing focus on precision medicine and personalized therapies is driving the demand for advanced extraction solutions in these sectors.

Contract Research Organizations (CROs)

Contract research organizations provide specialized services in nucleic acid extraction and analysis for various clients, supporting the advancement of clinical research. CROs offer expertise and resources that enable pharmaceutical and biotechnology companies to conduct research efficiently and cost-effectively. The growing demand for outsourced research services and the need for specialized extraction technologies are contributing to the growth of the CRO segment.

Others

Other end-users, including forensic labs and environmental testing agencies, also contribute to the demand for nucleic acid extraction technologies. Forensic labs use these technologies for criminal investigations and genetic identification, while environmental testing agencies rely on extraction methods for analyzing genetic material from environmental samples. These diverse applications further expand the market for nucleic acid extraction instruments and reagents.

Regional Analysis

North America

North America remains a leading market for nucleic acid extraction instruments and reagents, driven by strong research infrastructure and high healthcare expenditure. The region’s advanced healthcare system, extensive research activities, and early adoption of new technologies contribute to its dominance in the market. Additionally, the presence of major market players and a well-established distribution network support the growth of the nucleic acid extraction market in North America.

Europe

Europe’s market is characterized by a robust healthcare system and significant investments in genomics research, supporting steady growth in the nucleic acid extraction sector. The region’s focus on advancing personalized medicine and enhancing research capabilities is driving the demand for advanced extraction technologies. Furthermore, the presence of leading research institutions and biotechnology companies contributes to the growth of the market in Europe.

Asia-Pacific

The Asia-Pacific region is experiencing rapid growth in the nucleic acid extraction market due to increasing research activities and improving healthcare infrastructure. The region’s expanding research initiatives, coupled with rising healthcare investments, are driving the demand for nucleic acid extraction solutions. Additionally, the growing emphasis on genomics research and diagnostics in countries like China and India is contributing to the market’s expansion.

Latin America

Latin America is witnessing gradual growth in nucleic acid extraction technologies, driven by rising research initiatives and healthcare advancements. The region’s improving research infrastructure and increasing focus on genetic testing and diagnostics are supporting the demand for nucleic acid extraction solutions. Although the market is still developing, there are significant opportunities for growth as the region continues to invest in healthcare and research capabilities.

Middle East & Africa

The Middle East and Africa market is expanding as countries in the region invest in improving healthcare facilities and research capabilities. The growing emphasis on enhancing healthcare infrastructure and supporting research initiatives is contributing to the demand for nucleic acid extraction technologies. Additionally, the increasing focus on addressing genetic disorders and advancing diagnostic capabilities in the region is driving market growth.

Competitive Landscape

Key Players

Leading companies in the nucleic acid extraction market include industry giants and innovative startups that offer a range of products and solutions. Major players in the market are continuously investing in research and development to introduce advanced extraction technologies and maintain their competitive edge. Companies such as Thermo Fisher Scientific, Qiagen, and Roche are among the key players driving innovation and market growth.

Recent Developments

Recent developments in the market include advancements in technology, strategic partnerships, and new product launches aimed at enhancing nucleic acid extraction processes. Companies are focusing on integrating next-generation sequencing technologies, improving automation capabilities, and expanding product portfolios to meet evolving customer needs. These developments are shaping the competitive landscape and driving the growth of the nucleic acid extraction market.

Strategies and Innovations

Companies are adopting strategies such as technology integration, product diversification, and R&D investments to stay competitive and meet evolving customer needs. Innovations in extraction technologies, such as automated systems and improved reagents, are key to addressing the increasing demand for high-performance solutions. Additionally, strategic partnerships and collaborations with research institutions and biotechnology companies are helping market players expand their reach and drive growth.

Future Outlook

The future of the nucleic acid extraction instruments and reagents market appears promising, with ongoing innovations and increasing demand across various sectors driving growth and development. As the field of molecular biology continues to advance, nucleic acid extraction technologies will remain fundamental to research and clinical applications. The integration of new technologies, the focus on personalized medicine, and the expansion of research and diagnostic capabilities are expected to drive the continued evolution of the market.

0 notes

Text

Rough timeline of the discovery of genes and DNA

(mostly condensed from the first half of S. Mukherjee, The Gene: An Intimate History, 2016, and this 1974 paper)

1857-1864: Gregor Mendel experiments with breeding peas at the monastery of Brno. The results show that information about flower color, pod shape etc. is transmitted in discrete blocks that do not mix, and can persist unexpressed in a generation to manifest again in the next.

1865-1866: Mendel's results are published in a minor journal and effectively forgotten for 35 years. He corresponds with physiologist Carl von Nägeli, who dismisses them as "only empirical" (???).

1868: Unaware of Mendel's work, Darwin proposes pangenesis as mechanism of heredity: every body part produces "gemmules" that carry hereditary information and merge to form gametes. This does not explain how new traits aren't immediately diluted out of existence, or why acquired changes aren't inheritable.

1869: Friedrich Miescher extracts a mysterious substance from pus on used bandages and salmon sperm. He calls it nuclein (later: chromatin), as it seems to be concentrated in cell nuclei.

1878: Albrecht Kossel separates nuclein into protein and a non-protein component, which he calls nucleic acid, and breaks it down in five nucleotides.

1882: Darwin dies, bothered -- among other things -- by the lack of a plausible mechanism to transmit new variation. Legend has it that Mendel's paper lay on a bookshelf of his study, unread.

1883: August Weissmann, noting that mice with cut tails always give birth to fully-tailed mice, theorizes that hereditary information is contained in a "germplasm" fully isolated from the rest of the body, contra pangenesis. At each generation, only germplasm is transmitted, and gives separate rise to a somatic line, i.e. the body, which isn't.

ca. 1890: Studying sea urchin embryos in Naples, Theodor Boveri and Wilhelm von Waldeyer-Hartz notice large coiled masses of nuclein inside cell nuclei which can be dyed blue with aniline. They call them chromosomes, literally "colorful bodies". Simultaneously, Walter Sutton discovers chromosomes in grasshopper sperm.

1897: Hugo de Vries, after collecting hundreds of "monstrous" plant varieties near Amsterdam, realizes (also unaware of Mendel's work) that each trait is due to a single discrete particle of information, never mixing with the others, which he calls pangene in homage to Darwin. He also notices the appearance of completely new variants, which he calls mutants. In the same year, Carl Correns -- a former student of Nägeli, who had completely neglected to mention Mendel's work -- reproduces it exactly in Tubingen with pea and maize plants.

1900: Having finally found out about Mendel's publication, De Vries rushes to publish his model before he can be accused of plagiarism, which happens anyway. Correns does the same. Erich von Tschermak-Seysenegg also independently recreates Mendel's results with pea plants in Vienna. Come on, guys, this is embarassing.

1902: Boveri and Sutton independently propose that hereditary information is carried by chromosomes. Supporters of this hypothesis generally hold that information is carried by proteins, with the simpler nucleic acids (only 5 nucleotides vs. 20 aminoacids) serving as scaffold.

1905: William Bateson coins the word genetics to describe the field growing mostly from De Vries' work. He realizes it should be possible to deliberately select organisms for specific individual genes. Meanwhile, Boveri's student Nettie Stevens discovers in mealworms a strangely small chromosome that is found only in males -- chromosome Y. This is the first direct evidence that chromosomes do, in fact, carry genetic information.

1905-1908: Thomas Hunt Morgan and his students breed and cross thousands of fruit flies in a lab in New York. Contra Mendel, they notice that traits are not passed down in a completely independent way: for example, male sex and white eyes usually manifest together. This suggests that their information particles are attached to each other, so that the physically-closest traits are more likely (but not guaranteed!) to be transmitted together.

1909: Phoebus Levene and his coworkers break down nucleic acids by hydrolysis into sugars, phosphate, and nucleobases. They assume that nucleobases must repeat along a chain in a repetitive sequence. In a treatise on heredity, Wilhelm Johannsen shortens "pangene" to gene. It's a purely theoretical construct, with no known material basis.

1911: Using Morgan's data on trait linkage, his student Alfred Sturtevant draws the first genetic map, locating several genes along a fruit fly chromosome. Genetic information now has a physical basis, although not yet a mechanism of transmission.

1918: Statistician Ronald Fisher proposes that traits appearing in continuous gradients, such as height, can still be explained by discrete genes if multiple genes contribute to a single trait, resolving an apparent contradiction. (Six genes for height, for example, are enough to produce the smooth bell curve noticed half a century earlier by Francis Galton.)

ca. 1920: Bacteriologist Frederick Griffith is studying two forms of pneumococcus, a "smooth" strain that produces deadly pneumonia in mice (and people) and a "rough" strain that is easily dispatched by immunity. He finds out that if live "rough" pneumococci are mixed with "smooth" ones killed by heat, the "rough" can somehow acquire the deadly "smooth" coating from the dead.

1926: Hermann Muller, another student of Morgan, finds out he can produce arbitrary amounts of new mutant flies by exposing their parents to X-rays.

1928: Griffith describes the acquired "transformation" of bacteria in an extremely obscure journal.

1929: Levene identifies the sugars in "yeast nucleic acid" and "thymus nucleic acid" as ribose and deoxyribose, respectively. The two will henceforth be known as ribonucleic acid (RNA) and deoxyribonucleic acid (DNA).

ca. 1930: Theodosius Dobzhansky, who also had worked with Morgan, discovers in wild-caught fruit flies variations of wing size, eye structure etc. that are produced by genes arranged in different orders on the chromosome. This rearrangement is the first physical mechanism for mutation discovered.

1940: Oswald Avery repeats Griffith's experiments with pneumococci, looking for the "transforming principle". Filtering away the remains of the cell wall, dissolving lipids in alcohol, destroying proteins with heat and chloroform does not stop the transformation. A DNA-degrading enzyme, however, does. Therefore, it is DNA that carries genetic information.

1943: By mixing flies with different gene orders and raising the mixed populations at different temperatures, Dobzhansky shows that a particular gene order can respond to natural selection, increasing or decresing in frequency.

1944: Avery publishes his results on transforming DNA. Physicist Erwin Schrödinger writes a treatise (What Is Life?) in which he states, on purely theoretical ground, that genetic information must be carried by an "aperiodic crystal", stable enough to be transmitted, but with a sequence of sub-parts that never repeat.

1950: In Cambridge, Maurice Wilkins starts using X-ray diffraction to try and make a picture of the atomic structure of dried DNA (as Linus Pauling and Robert Corey had done earlier with proteins). He is later joined by Rosalind Franklin, who finds a way to make higher-quality pictures by keeping DNA in its hydrated state. By hydrolyzing DNA, Erwin Chargaff notes that the nucleobases A and T are always present in exactly the same amount, as if they were paired, and so are C and G -- but A/T and C/G can be different amounts.

1951: Pauling publishes a paper on the alpha-helix structure of proteins. Having attended talks by Wilkins and Franklin, James Watson and Francis Crick attempt to build a physical model of DNA, a triple helix with internal phosphate, but Franklin notes it's too unstable to survive.

1952: Alfred Hershey and Martha Chase mark the protein envelope of phage viruses with radioactive sulfur, and their DNA with radioactive phosphorus. The phosphorus, but not the sulfur, is transmitted to host bacteria and to the new generation of phages. This indicates that DNA is not just exchanged as "transforming principle", but passed down through generations.

1953: Pauling and Corey also propose a structure of DNA, but they make the same mistake as Watson and Crick. These receive from Wilkins an especially high-quality photo (taken in 1952 by either Franklin or her student Ray Gosling). Combining this picture with Chargaff's measurements, they conclude that DNA must be a double helix, with a sugar-phosphate chain outside, and nucleobases meeting in pairs on the inside (A with T, C with G). The complementary sequences of bases give a clear mechanism for the storage and replication of genetic information.

1950s: Jacques Monod and François Jacob grow the bacterium Escherichia coli alternately on glucose and lactose. While its DNA never changes, the RNA produced changes in step with the production of glucose-digesting and lactose-digesting enzymes. So DNA is not directly affected, but different sequences are copied onto RNA depending on need.

1958: Arthur Kornberg isolates DNA polymerase, the enzyme that builds new DNA strands in the correct sequence. By inserting into DNA a heavier isotope of nitrogen, Matthew Meselson and Franklin Stahl show that each strand remains intact, separating during replication and then serving as template for a new one.

1960: Sydney Brenner and Jacob purify messenger RNA from bacterial cells. This seems to copy the sequence of a single gene and carry it to ribosomes, where proteins are built. RNA must encode the sequence of aminoacids of a protein, presumably in sets of 3 nucleotides (the smallest that can specify 20 aminoacids).

1961-1966: Multiple labs working in parallel (Marshall Nirenberg-Heinrich Matthaei-Philip Leder, Har Khorana, Severo Ochoa) map every possible triplet of nucleotides to a corresponding aminoacid. Synthetic RNA is inserted into isolated bacterial ribosomes, and aminoacids are marked one at a time with radioactive carbon to check the sequence of the resulting proteins.

1970: Paul Berg and David Jackson manage to fuse DNA from two viruses into a single sequence ("recombinant DNA") using DNA-cutting enzymes extracted from bacteria.

1972-1973: Janet Mertz joins Berg and Jackson, and proposes inserting the recombinant DNA into the genome of E. coli, exploiting the bacterium for mass production. Herb Boyer and Stanley Cohen perform a similar experiment merging bacterial DNA, and linking it to an antibiotic-resistance gene so that the recombinant bacteria can be easily isolated.

1975-1977: Frederick Sanger isolates template strands of DNA to build new ones with DNA polymerase, but uses altered and marked nucleobases that stop polymerization. By doing so, then segregating the shortened sequences by length and recognizing their final base with fluorescence, it's possible to read the exact sequence of bases on a DNA strand.

350 notes

·

View notes

Note

Hello, Mr. Holmes! How are you?

So, long story short, I ended up with an optical microscope in my room more or less 4 months ago, with 200 previously made slides (secured in a proper box), and lots of new ones too, for me to prepare myself. I love microbiology (it's one of my hyperfixations, curse my neurodivergency) and now I love it even more (my mother has had to drag me away from the microscope - I named it Wesley - in the middle of the night multiple times now).

After much conversation, I finally convinced my mom to buy me the proper equipment to prepare the slides!

So, I'm sending this ask to you, as I know you also have a microscope and that you use it a lot: what kind of equipment do you recommend me buying (gloves, scalpel blades, tints, etc), while still remembering that all of the stuff needs to stay in my room (properly taken cared of by me, of course)?

For example, I'm unsure if different dyes are used for different smears and specimens due to it's affinity (I've noticed that on 'organic matter' slides, images are usually tinted purple or pink, while on plant-based slides, images are usually tinted green and blue, with a few red structures.) Considering that I don't have access to a mortuary, I will mostly make plant slides. There must be a difference in the dyes then, right?

Sorry for the long text! Hope this isn't too much of a bother.

- a 17-year-old :)

Congratulations on your new light microscope. I do hope you get the best out of it. I am overjoyed that someone else appreciates the art of microscopy and microbiology.

However, you need to be careful to not strain your eyes. It is recommended to take breaks every 15 minutes to close your eyes or focus on something in the distance to reaccommodate your eyes. And get up every 40 minutes, stretch and correct your posture. And it is recommended to not use a microscope more than 5 hours per day. John has to chase me away from my microscope sometimes to take a break when I sit there for hours, my posture like a Caridea.

Concerning equipment, you will obviously need a scalpel or other sharp blade to make very thin slices of your specimen, as thin as possible. And forceps to move your samples (best just get a whole dissection kit it has everything). Obviously slides and coverslips, pipettes for the stains or water, maybe some tubes. A pen to label your slides. In many staining procedures ethanol or acetone is also used. A waste jar to safely dispose of any chemicals, but be careful what you mix. A rack for staining and containers. I would recommend nitrile gloves, some people are sensitive to latex.

The dyes you use depend on the specimen. For example in histological slides of tissues hematoxylin and eosin are most commonly used (short HE-stain). That's what you most likely saw on your slides, it's blue, purple and pink. Hematoxylin is a basic compound extracted and oxidised from the logwood tree (Haematoxylum campechianum), and it stains acidic compounds in the cells (or basophilic because they have an affinity for basic substances). For example nucleic acids like DNA or RNA get stained by hematoxylin because they are basophillic. And where are lots of nucleic acids? In the nucleus and ribosomes, that is why they appear blue to purple in the staining because they bind hematoxylin. Eosin is an acidic compound, and stains basic or acidophilic compounds red or pinkish, like proteins, collagen, cytoplasm, extracellular matrix.

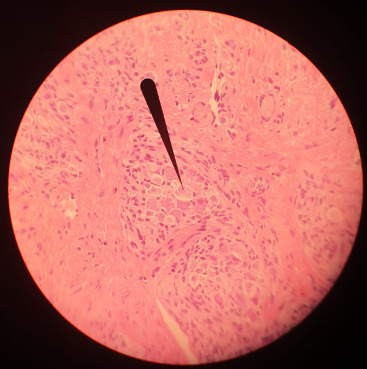

(Ductus epididymidis with HE-stain)

(Tongue HE-stain, pointer marking a ganglion; that is my picture)

Of course there are more specific stains for specific tissues like Golgi's silver staining for neurons.

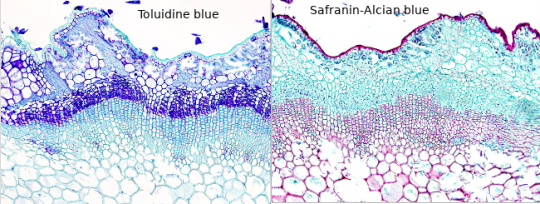

For plants toluidine blue is often used, high affinity for acidic tissues, and can stain blue to green to purple. It is often combined with safranin, a basic azine, which is probably the red stain you saw. It stains polysaccharides and lignin, woody parts of the plant. Safranin and astrablue is also often combined, astrablue stains non-lignified parts of the plant.

(Ulex europaeus stem; not my pictures I don't have any samples currently, source Atlas of plant and animal histology)

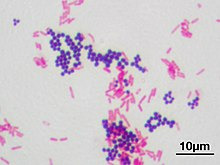

Safranin is also used in bacteriology, in the famous Gram staining. In Gram staining you use crystal violet (blue/purple), Lugol's iodine solution, then wash it with ethanol and add safranin (red) as a counter stain. Bacteria is gram-positive if the crystal violet stays in their thick murein cell wall, can't be washed out with the ethanol and the bacteria stays blue. Gram-negative appear red because of the counterstain.

(Staphyloccocus aureus (violet, gram positive) & Escherichia coli (red, gram negative); not my picture, source Wikipedia)

However, I am not sure whether you have access to any of those substances, if they are too expensive for you or if they are too hazardous if used in your own room for a prolongued time. Of course those substances need to be stored properly, and your own room is probably not a good place, especially for ethanol or acetone. The fumes. I would recommend to ask your biology or chemistry teacher whether they can recommend anything further and where to buy said solutions in your area, and if they can't they are idiots. There are also many useful resources and tutorials on Youtube.

Another fascinating experiment for your microscope, that you can perform without buying any chemicals, is a hay infusion. You put hay into a container filled with water, and let it sit undisturbed for a week in a sunny area but not in direct harsh sunlight. During that time the microorganisms in the hay are reproducing in the solution, feeding on the polysaccharides of the hay. Protozoans also flourish in the hay infusion and eat the bacteria. It might get cloudy and a bit foul smelling (best not do it in your own room if you don't want to sleep next to a rotting smell). When you put a drop of the solution onto a slide and look at it in the microscope, you should see a variety of microorganisms like bacteria (like Bacillus subtilis), amoeba, ciliates, heliozoa, algae et cetera. At different depths of the liquid you should find different kinds of organisms, because of differing oxygen content. However, pathogens can also occur in the hay infusion so handle it carefully and work sterile, wash your hands properly.

And even if you don't work at a morgue you can still get tissue samples to experiment on, after all meat is sold in supermarkets, basically the same as a human body. And at the butchers they even sell organs like chicken hearts, pig kidney, liver, blood et cetera. Or observe your own hair under the microscope.

Which kind of samples and slides were included in your starter kit? Be careful to not leave them lying around in the sunlight, or the stain might fade. Always store them in the proper box.

#roleplay#rp#sherlock roleplay#sherlock rp#johnlock roleplay#johnlock rp#sherlock#bbc sherlock#sherlock holmes#sherlock holmes rp#sherlock holmes roleplay#science#scientist#research scientist#histology#microscope#microscopy#bacteria#bacteriology#pathology#anatomy#biology#chemistry#scientists#pictures#he stain#specimen#samples#slides#sherlock replies

47 notes

·

View notes

Text

youtube

𝗔𝘁𝗵𝗲𝗻𝗲𝘀𝗲-𝗗𝘅'𝘀 𝗠𝗼𝗹𝗲𝗰𝘂𝗹𝗮𝗿 𝗗𝗶����𝗴𝗻𝗼𝘀𝘁𝗶𝗰 𝗥𝗮𝗻𝗴𝗲𝘀!

Athenese-Dx MolDx ranges are engineered for precision, accuracy, and reliability. Our comprehensive suite includes:

1. DNA/RNA Extraction Kits – High-yield & pure nucleic acid extraction 2. Nucleic Acid Extractor – Automated, fast, and efficient workflow

𝗥𝗲𝗮𝗹-𝗧𝗶𝗺𝗲 𝗣𝗖𝗥 𝗞𝗶𝘁𝘀:

1. HBV & HCV (Quantitative) – Accurate viral load detection 2. Typhoid & Leptospira (Qualitative) – Rapid & reliable pathogen identification

Watch the video to learn more.

Visit → https://athenesedx.com/product-category/molecular-pcr-kits/

AtheneseDx #PCRKits #MolecularDiagnostics #IVD #India #PCR #RealTimePCR #NewProductLaunch #LaboratoryExcellence #DiagnosticSolutions #Diagnostics #Pathology #Medical #Medicine #Practitioner #ClinicalDiagnostics #ClinicalChemistry #ELISA #RapidTest #ClinicalLaboratory #RTPCR #Healthcare #InVitroDiagnostics #LabSupplies #LaboratorySupplies #DiagnosticKits

#ivd#lab equipment#clinical chemistry#pathologist#pathology#pathologylab#hospital#digital pathology market#athenesedx#biochemistry#medical laboratory science#medical equipment#medical research#medical supplies#medical support#health#molecular biology#moleculardiagnostics#healthcare#medicine#health and wellness#Youtube

2 notes

·

View notes

Text

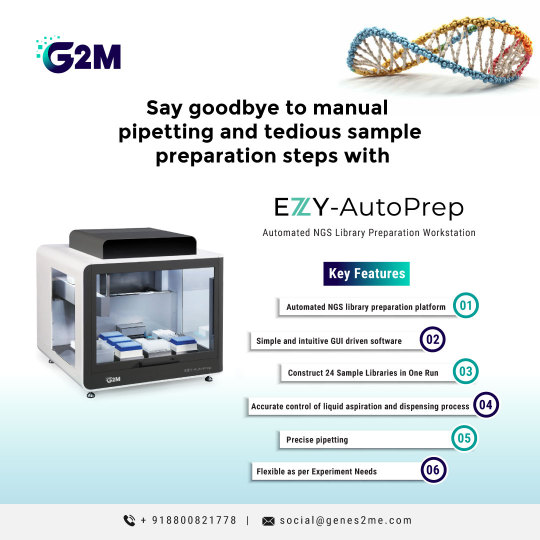

Introducing G2M’s newly launched EZY-AutoPrep—an automated #NGS library preparation workstation capable of constructing 24 sample libraries in a single run. With user-friendly software and supporting hardware, EZY-#AutoPrep ensures quick sample processing, delivering a seamless library preparation experience. Features include heating, cooling, #magnetic plate lifting, #PCR cycling, UV sterilization, and efficient purification which ensures precise, contamination-free library construction.

#Revolutionize your #NGS workflow with EZY-AutoPrep.

Visit our website for more information: https://genes2me.com/automated-ngs-library-sample-preparation

For more details, Call us at +91-8800821778 or drop us an email at [email protected]

#rtpcr #genes2me #nextgenerationsequencing #nextgeneration #sequencing #automated #ivd #dna #rna #protocols #nucleicacid

#rt-pcr#pcr#g2m#genes2me#ivd#ngs#revolutionize#AutoPrep#magnetic#dna solutions#rna solutions#automated#nucleic acid#nucleic acid extraction

0 notes

Text

hey if youre on turtle island or still tuesday and feel like trying a quick silly browser game you should check out tradle. (i think it updates at midnight based on time zones?) todays is real fun i prommy.

you get five guesses to figure out a country from its export data, and after each guess they tell you how far away you are and what direction the county youre looking for is. i know it sounds like a ridiculous challenge but this one has a bunch of easy hints and giveaways that are accessible to your average westerner

if its wednesday by now or you want to see the data presented differently check out this silly economy under the cut (bolded 'spoilers' ig)

total export value: 371b (usd)

gold: 86.7b (23%}

packaged meds: 48.5b (13%)

vaccines, blood, cultures, etc: 40.3b (11%)

base metal watches: 15.2b (4%)

nitrogen heterocyclic compounds: 14.2b (4%)

jewlery: 9.35b (2.5%)

precious metal watches: 8.97b (2.5%)

orthopedic appliances: 7.02b (2%)

hormones: 3.38b

coffee: 3.36b

electricity: 3.19b

medical instruments: 3.09b

machinery w indv functions: 3.04b

platinum: 2.54b

chemical analysis instruments: 2.27b

nucleic acids: 2.17b

valves: 2.17b

silver: 2.01b

electric motors: 1.78b

scented mixtures: 1.72b

sulfonamides: 1.71b

diamonds: 1.64b

planes, helicopters, and spacecraft: 1.63b

beauty products: 1.58b

other heating machinery: 1.43b

flavored water: 1.43b

gas turbines: 1.38b

low voltage protection eq: 1.34b

gas and liquid flow measuring inst: 1.3b

carboxyamide compounds: 1.26b

other measuring instruments: 1.24b

air pumps: 1.16b

motor vehicles, parts, and acc: 1.14b

petroleum gas: 1.12b

electrical transformers: 1.11b

aluminum plating: 1.07b

other plastic products: 1.01b

metal working machine parts: 988m

vitamins: 965m

polyamides: 963m

washing and bottling machines: 925m

chocolate: 887m

oxygen amino compounds: 885m

integrated circuits: 884m

iron fasteners: 881m

paintings: 873m

transmissions: 855m

special pharmaceuticals: 837m

insulated wire: 828m

electrical power accessories: 826m

plastic lids: 818m

cheese: 800m

antibiotics: 797m

liquid pumps: 797m

cars: 789m

ink: 752m

non mechanical removal machinery: 737m

trunks and cases: 734m

centrifuges: 730m

interchangeable tool parts: 728m

high voltage protection eq: 705m

hand saws: 693m

other edible preparations: 680m

electric heaters: 679m

electrical control boards: 672m

polyacetals: 664m

plastic pipes: 636m

electric soldering equipment: 616m

precious metal compounds: 608m

industrial fatty acids, oils, and alcohols: 608m

hot rolled iron bars: 590m

self propelled rail transport: 582m

refined petroleum: 577m

hydrazine or hydroxylamine derivatives: 565m

precious stones: 563m

rubber working machinery: 561m

unpackaged meds: 557m

other iron products: 553m

precious metal scraps 550m

computers: 545m

surveying equipment: 523m

other plastic sheetings: 519m

metal finishing machines: 516m

scrap copper: 514m

semiconductor devices: 511m

raw plastic sheeting: 494m

documents or title and stamps: 490m

rolled tobacco: 487m

malt extract: 469m

other electrical machinery: 467m

other paper machinery: 450m

oxygen heterocyclic compounds: 441m

non knit mens suits: 441m

synthetic coloring matter: 436m

locomotive parts: 432m

non knit womens suits: 428m

iron structures: 424m

leather footwear: 421m

industrial printers: 415m

lifting machinery: 415m

scrap iron: 412m

therapeutic appliances: 410m

office machine parts: 410m

other clocks and watches: 405m

metal molds: 403m

other furniture: 403m

glaziers putty: 377m

liquid dispersing machines: 376m

knitting machine accessories: 370m

other small iron pipes: 369m

broadcasting equipment: 367m

aircraft parts: 363m

industrial food prep machinery: 362m

glues: 357m

pesticides: 349m

oscilloscopes: 344m

raw aluminum: 344m

knit sweaters: 339m

optical fibers and bundles: 334m

excavation machinery: 332m

non iron/steel slag ash and residue: 319m

carboxylic acids: 315m

xray equipment: 315m

electric motor parts: 315m

watch straps: 313m

tanks and armoured vehicles: 310m

forging machines: 309m

cleaning products: 306m

metalworking transfer machines: 298m

animal food: 294m

combustion engines: 282m

engine parts: 271m

electric generating sets: 254m

scrap aluminum: 249m

laboratory reagents: 249m

perfumes: 244m

other rubber products: 241m

photo lab equipment: 240m

wheat: 236m

lubricating products: 234m

printed circuit boards: 233m

aluminum bars: 230m

explosive ammunition: 230m

brooms: 224m

lcds: 223m

refrigerators: 223m

motorcycles and cycles: 221m

large construction vehicles: 221m

coal briquettes: 221m

corn: 220m

aluminum cans: 219m

textile footwear: 217m

thermostats: 207m

coffee and tea extracts: 206m

other aluminum products: 204m

ball bearings: 203m

knives: 199m

machines for additive mnf: 195m

raw iron bars: 187m

delivery trucks: 185m

milling stones: 176m

aluminum foil: 170m

collectors items: 169m

soybean oil: 169m

wood fiberboard: 166m

other stainless steel bars: 164m

sculptures: 160m

cutting blades: 159m

baked goods: 150m

navigation equipment: 146m

hydrometers: 137m

watch cases and parts: 134m

laboratory ceramic wear: 134m

wood carpentry: 124m

mirrors and lenses: 117m

#the plastic lids is the most astonishing thing out of all this i think. 800m usd in exports.... to go on what??#i wanted to visualize the data by smaller category#ig sharing my autism again stayed up til 3 last night transfering this lol

2 notes

·

View notes

Text

Market Opportunities in Sequencing Kits Segment

The Global Sequencing Kits Market: What Industry Leaders Need to Know

The global sequencing kits market is experiencing remarkable growth, and industry leaders are facing some tough decisions. With projections showing the market will reach $25.29 billion by 2031 and grow at an impressive 15.5% annually, companies can't ignore what's happening in this space. What's particularly striking is how dramatically costs have fallen—sequencing a human genome cost $29,092 back in 2010, but today that same process costs just $562. This massive cost reduction has opened doors that were previously unimaginable.

The Battle for Market Leadership in an NGS World

Next-generation sequencing isn't just growing—it's dominating. NGS technologies now control 78.2% of the entire market, which fundamentally changes how companies need to think about competition. When you consider that nucleic acid extraction and amplification kits alone make up 33.0% of the total market share, it becomes clear that this isn't just about having good technology anymore.

The geographic picture tells an interesting story too. North America still holds the biggest slice of the pie at 50.8% market share, but Asia-Pacific is where the real action is happening. That region is growing at 17.3% per year, which is the fastest rate globally. Companies like Beijing Genomics Institute from China aren't just participating in this growth—they're driving it, and that's making established Western companies rethink their strategies.

What's particularly concerning for traditional players is what's happening in emerging markets. Latin America, for instance, is expecting 1.9 million new cancer cases by 2030, jumping to 2.4 million by 2040. These numbers represent real business opportunities, but they also come with pricing pressures that many established companies haven't had to deal with before.

Investment Decisions That Will Define the Future

Companies are wrestling with where to put their research and development dollars. While NGS clearly dominates today, newer technologies like third and fourth-generation sequencing are emerging. The sequencing kits and reagents segment is expected to grow at 16.9% annually through 2031, which suggests there's still plenty of room for innovation.

But here's where it gets complicated: precision medicine is changing everything. Doctors are increasingly using genomic information to create personalized treatments for patients, and this trend is accelerating fast. Companies have to decide whether to bet big on these emerging applications or focus on improving the NGS technologies that are already working well.

Cancer treatment provides a perfect example of this dilemma. Molecular profiling of cancer cells has become standard practice in many hospitals, creating demand for specialized sequencing applications. However, nobody knows how many companies this market can realistically support before competition becomes too intense.

Business Models Under Pressure

The way companies make money in this industry is changing rapidly. What works in North America, where premium pricing is often acceptable, doesn't necessarily work in Asia-Pacific, where volume-based strategies make more sense. This geographic split is forcing companies to rethink their entire approach to pricing and market entry.

Pharmaceutical and biotechnology companies have become the largest customers in this space, driven by their increasing focus on drug discovery and cancer research. While this provides stable demand, it also creates a dependency that makes some sequencing kit manufacturers nervous. These big pharmaceutical companies have a history of eventually bringing capabilities in-house when they become strategic enough.

The customer landscape shows clear preferences too. Research applications still generate the most revenue today, but clinical applications are growing much faster. Companies have to decide whether to double down on their research market strength or pivot more aggressively toward clinical applications where the future growth appears to be.

Geography as Strategy

Regional differences aren't just about market size—they're about fundamentally different approaches to healthcare and research. Asia-Pacific's demographics are particularly compelling for sequencing companies. Currently, 12.7% of the region's population is 65 or older, but that number is projected to hit 25.7% by 2050. An aging population means more cancer cases, more genetic testing, and more demand for sequencing services.

Countries like China, India, Brazil, and Mexico have become major revenue sources, supported by growing numbers of research institutions and pharmaceutical companies. However, these markets often involve government funding and public health initiatives, which can favor local companies or those with strong regional partnerships.

Key Players Reshaping the Industry

The competitive landscape reflects both established dominance and emerging challenges. Illumina, Inc. remains a major force, while Thermo Fisher Scientific Inc. and F. Hoffmann-La Roche Ltd. compete through broad product offerings that serve multiple market segments.

Specialized companies like Pacific Biosciences of California, Inc. and Oxford Nanopore Technologies Plc. are carving out niches with advanced sequencing technologies that traditional players struggle to match. Meanwhile, Agilent Technologies, Inc., PerkinElmer, Inc., and QIAGEN N.V. leverage their instrumentation expertise to capture specific customer segments.

Beijing Genomics Institute represents the growing influence of Asian companies, particularly as regional demand accelerates. Danaher Corporation, Bio-Rad Laboratories, Inc., and 10X Genomics, Inc. complete the competitive picture with specialized offerings that target specific applications.

These companies face a common challenge: customers increasingly want complete solutions rather than individual products. This means developing capabilities across multiple areas—nucleic acid extraction, library preparation, and quality control—rather than excelling in just one area.

Applications That Matter Most

The application side of the market reveals where the real opportunities lie. Research applications currently dominate revenue, driven by falling costs and the impressive capabilities of modern sequencing technologies. However, clinical applications show much stronger growth potential across oncology, reproductive health, and drug discovery.

Precision oncology deserves special attention. Molecular profiling to identify biomarkers has become routine in many cancer centers, supported by technologies that can sequence multiple genes quickly and reliably. This trend suggests that clinical applications might eventually overtake research in terms of market importance.

Academic and research institutions represent another significant opportunity, though they operate differently than commercial customers. These organizations often depend on grant funding, which makes them more price-sensitive but also provides predictable demand cycles when funding is available.

Building Sustainable Advantages

Success in today's market requires more than just good technology. Companies need to think about integration, geography, and customer relationships in ways that weren't necessary when the market was smaller and less competitive.

Regional manufacturing capabilities offer advantages beyond just cost savings. They provide supply chain resilience and help companies respond to local market needs more effectively. However, these investments require significant capital and must be balanced against uncertain demand patterns.

The transformation from selling products to providing solutions represents perhaps the biggest strategic shift in the industry. Pharmaceutical and biotechnology companies want partners who can handle their entire sequencing workflow, not vendors who provide individual components.

Looking Ahead

The global sequencing kits market offers tremendous opportunities, but success requires clear thinking about technology platforms, geographic priorities, and customer segments. Companies must navigate a world where established NGS technologies coexist with emerging alternatives, where developed markets provide stability while emerging regions drive growth, and where current research applications compete with future clinical uses for investment dollars.

The industry is shifting from being technology-driven to applications-driven, which changes everything about how companies should think about competition and growth. Organizations that can answer fundamental questions about their competitive positioning, geographic expansion plans, and customer priorities will capture the most value in a market that's experiencing unprecedented growth and change.

Download Sample Report Here @ https://www.meticulousresearch.com/download-sample-report/cp_id=5656

Contact Us: Meticulous Research® Email- [email protected] Contact Sales- +1-646-781-8004 Connect with us on LinkedIn- https://www.linkedin.com/company/meticulous-research

#SequencingKits#Genomics#NextGenerationSequencing#MolecularBiology#LifeSciences#PersonalizedMedicine#GeneticTesting#BiotechIndustry#HealthcareInnovation#MedicalResearch

0 notes

Text

0 notes

Text

Portable PCR Systems Market Drivers Accelerating Global Demand for Rapid Testing

The global portable PCR Systems market is experiencing significant momentum, driven by a growing need for fast, accurate, and accessible diagnostic solutions across diverse sectors. Polymerase Chain Reaction (PCR) technology has long been the gold standard for detecting pathogens, genetic mutations, and infectious diseases. With the miniaturization of PCR systems, the diagnostic process has become more mobile, efficient, and adaptable to field settings, making it indispensable in both healthcare and non-clinical applications.

The demand for portable PCR devices surged notably during the COVID-19 pandemic, demonstrating their potential in controlling infectious disease outbreaks. Today, beyond pandemic response, various market drivers are shaping the future growth trajectory of this innovative sector.

Key Market Drivers

1. Growing Need for Point-of-Care and Field Diagnostics

One of the most prominent drivers for portable PCR Systems is the escalating demand for point-of-care (POC) and field-based testing solutions. Traditional laboratory-based diagnostics, while highly accurate, often require significant time, complex infrastructure, and skilled personnel. Portable PCR systems overcome these limitations by offering rapid, real-time detection capabilities at the patient’s location or in remote areas.

Applications include infectious disease detection, genetic analysis, environmental monitoring, and even food safety testing. Governments, healthcare providers, and research organizations increasingly rely on portable PCR technology to deliver immediate results, especially in underserved or emergency settings.

2. Rising Incidence of Infectious Diseases

The global surge in infectious diseases, including respiratory infections, sexually transmitted diseases, and emerging zoonotic threats, is a significant growth catalyst. Recent outbreaks like COVID-19, monkeypox, and avian influenza have highlighted the necessity for scalable, decentralized testing capabilities. Portable PCR systems enable health authorities to conduct rapid screenings, contact tracing, and mass testing programs efficiently.

Moreover, portable PCR devices are being deployed for early detection of antimicrobial resistance (AMR), a growing public health concern worldwide. The ability to deliver quick, on-site molecular diagnostics enhances outbreak management and mitigates the spread of infections.

3. Technological Advancements in Miniaturization and Automation

Continuous technological innovations have significantly improved the efficiency, portability, and affordability of PCR systems. Miniaturization of components, integration of microfluidics, and advancements in thermal cycling technologies have enabled manufacturers to develop lightweight, battery-operated, and user-friendly devices without compromising accuracy.

Additionally, automation features such as sample preparation, nucleic acid extraction, and real-time result reporting have enhanced usability, reducing the need for specialized training. These advancements have expanded the application scope of portable PCR beyond clinical diagnostics to agriculture, veterinary care, and biodefense sectors.

4. Increased Adoption in Environmental and Food Safety Testing

The versatility of portable PCR technology extends beyond healthcare. Growing concerns regarding foodborne pathogens, contamination, and environmental hazards are boosting adoption in food safety and environmental monitoring. Portable PCR devices allow on-site detection of contaminants like E. coli, Salmonella, or Listeria in food processing plants, reducing the risk of outbreaks and enhancing regulatory compliance.

In environmental testing, portable PCR systems assist in monitoring water quality, detecting harmful microorganisms, and ensuring public health safety, especially in disaster zones or resource-limited regions.

5. Expanding Applications in Veterinary and Agricultural Sectors

The animal health sector is another emerging area propelling market growth. Portable PCR systems are increasingly used for early detection of animal diseases, which is crucial for preventing outbreaks that can devastate livestock populations and threaten food security. Farmers and veterinary professionals leverage portable PCR technology to conduct rapid disease diagnostics on farms, minimizing economic losses and safeguarding animal welfare.

In agriculture, these systems facilitate the identification of plant pathogens, enhancing crop protection efforts and promoting sustainable farming practices.

Conclusion

The portable PCR Systems market is set to expand as technological innovation converges with a rising global emphasis on rapid diagnostics, disease prevention, and public health safety. With diverse applications across healthcare, environmental monitoring, food safety, and agriculture, portable PCR devices are poised to transform the landscape of molecular diagnostics. As demand for decentralized, accurate, and efficient testing grows, stakeholders across industries are increasingly investing in portable PCR solutions, underscoring their vital role in shaping the future of diagnostics.

0 notes

Text

0 notes